Kstack Exceptions - Chargeback

Kstack's platform for managing exceptions in payments.

Payments – Chargeback Exceptions

Kstack, the Knowledge Stack, is a technology company that has helped dozens of clients in their processes of Digital evolution, renewal or transformation; so it was natural to evolve towards solutions that could accelerate or help companies in their business challenges.

When the company defined the strategic business lines for solutions, Payments was a natural patch due to the experience of years in this area, either through projects or through previous experience in reference companies in the Brazilian market.

Since its inception, the Brazilian payments market has stood out for its dynamism and creativity, as well as the lack of solutions (or systems) that would meet 100%+ business demands: retailer installments, issuer installments, “rail cleaner” and other functions so peculiar to our market. The alternative has always been to develop “extensions” to the systems, adjusting as needed – always version 1.0...

The absence of a specific and adequate solution for handling Exceptions and the impacts that such situations have on the participants, from the merchant at one end to the buyer at the other end, results in a high financial and image cost, with impacts on credibility, normally resulting in loss of market share.

With this perspective, Kstack defined its strategy for Payments:

- A platform for handling Exceptions (Exceptions)

- Development of the first solution: CHARGEBACK for Acquirer or Sub Acquirer.

- In the strategic roadmap we have:

- Fee collections

- Cancellation

- ISSUER chargeback

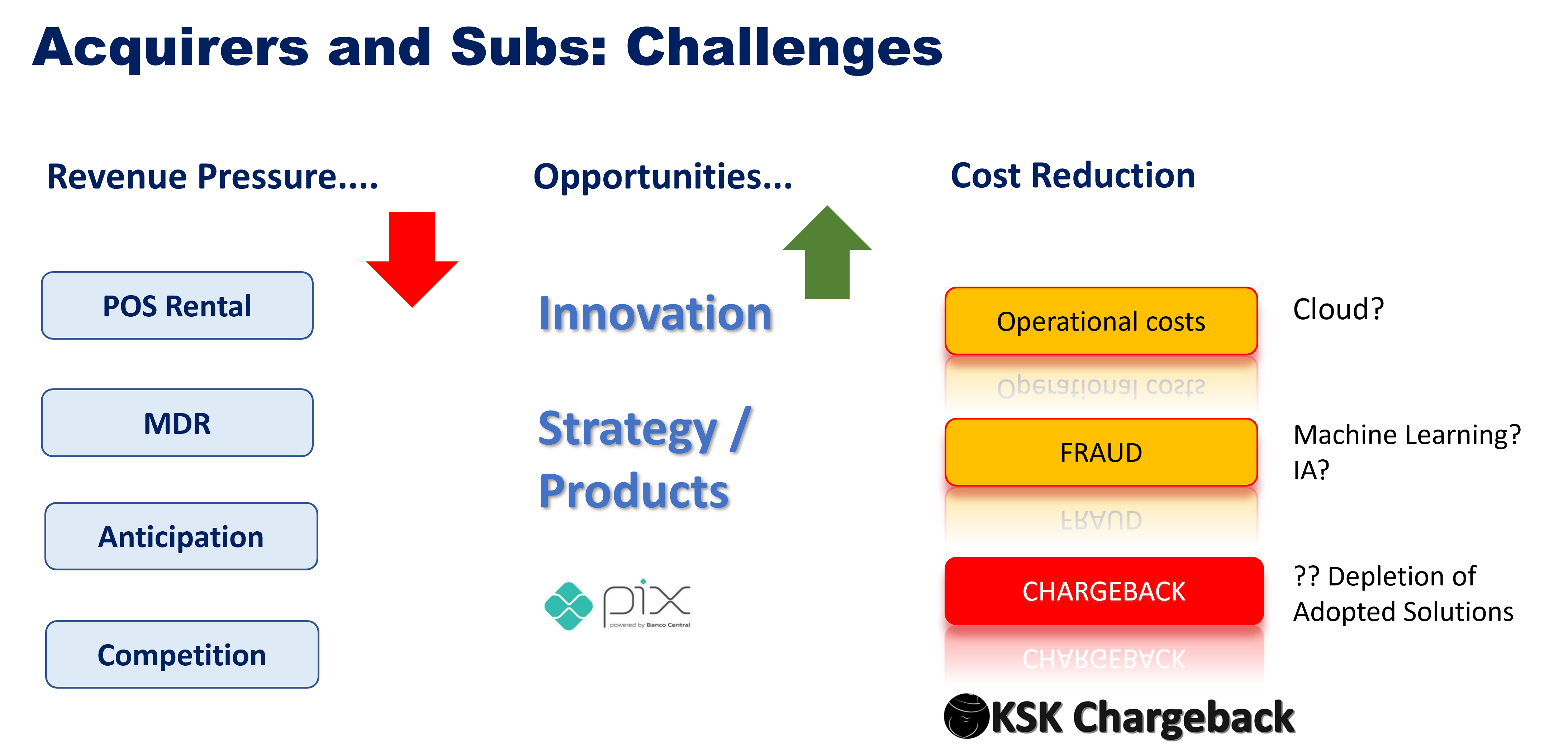

Challenges in a highly competitive environment

Chargeback

CONTEST, DISPUTE

Chargeback is a transaction dispute initiated by the cardholder directly with the issuing bank, which is handled by the Acquirer (or Sub-Acquirer). Behind this definition lies a range of impacts on all participants in the purchase flow of a product. Some are affected more, others less, but ultimately, everyone ends up losing financially, in terms of reputation, credibility, and market share.

We understand that Chargeback can indeed be considered as part of the service sale, bringing new sources of revenue in addition to reducing operational costs. This can be achieved through the use and implementation of filters, process automation, structured within client-defined parameters, minimizing the need for system customization or adjustments. Chargeback can also serve as a differentiating element in the market and be part of the customer loyalty process.

Chargeback and Fraud Prevention are essential elements for effective risk management.

Chargeback

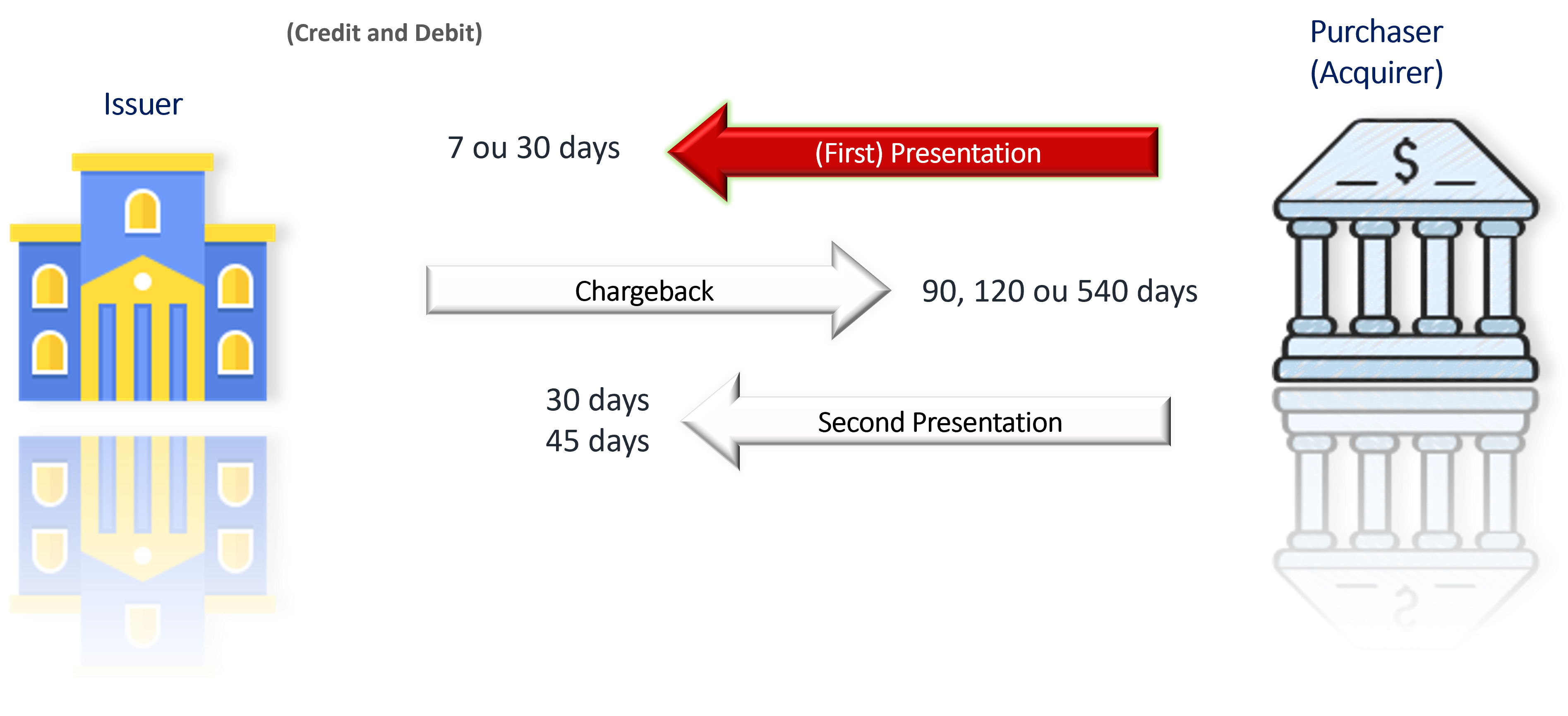

Chargeback Cycles (DUAL MESSAGE)

After the initial presentation of a transaction, the complete lifecycle of a chargeback includes the first chargeback, second representation, and arbitration.

Funds are settled/transferred with each presentation message and chargeback. The Issuer or Acquirer is both credited and debited depending on the stage of the process.

KSK Exceptions - Chargeback

KSTACK'S INNOVATIVE SOLUTION

- Application of business, technical and operational knowledge in a modern and flexible architecture.

- Processes automation via flexible and oriented parameters to resolve as many cases as possible and avoid procedural deviations.

- Operational management in all aspects of chargeback.

- Ease of integration with a production system (legacy) - via API's or files..

- Architecture aligned with trends.

- Headcount management: predictability and better performance of the operational team.

Case study:

- Operating cost reduction

- Floating

- Card Schemes costs

- Management + Predictability

Useful Links

PAYMENTS MARKET REFERENCES:

- Estatísticas de Meios de Pagamentos(bcb.gov.br)

- https://www.bcb.gov.br/#itemconcorrenciasfn

- https://www.bcb.gov.br/#itemarranjospagamento

- Pix (bcb.gov.br)

- ABECS

- Visa Chargeback - A User's Manual - How To Chargeback

- Chargeback Guide (mastercard.us)

- Chargeback Management Guide for Visa Merchants

- Febraban - Home